High security standards

Security is our top priority. We conduct rigorous checks, employ safe data storage, and comply with all regulations to ensure a stable and reliable payment platform. We continuously seek new technology and perform independent testing to improve further.

- Our methods also include:

- rigorous security checks

- safe data storage

- employee screenings

- compliance with the security standards and regulations.

Check the documentation below to know all the details.

Contact us

We adhere to the PCI Data Security Standard for Service Providers.

We follow the industry-standard secure coding guidelines.

Data is hosted in dedicated facilities with 24x7 security.

Certifications & Compliance

Our dedicated compliance team ensures that our procedures and policies align with industry standards. They identify necessary controls, processes, and systems to achieve compliance. Regular internal audits and independent assessments by third parties further reinforce our commitment to maintaining a high level of compliance.

PCI DSS Level 1 compliance

Payment Card Industry Data Security Standard (PCI DSS) is a security standard established by major payment systems. Compliance with this standard makes online transactions secure and protects them against identity theft. It increases cardholder data control and reduces fraud operations.

- Level 1 PCI compliant

- No need for you to be PCI compliant

- Industry recognition

- No prohibited data storage

Secure infrastructure

At Todapay, we adhere to the highest standards of security, integrity, and stability. We are fully aware of the trust you place in us by sharing your data, and we take every possible step to safeguard it. Our commitment to your data security is unwavering, and we are always seeking opportunities to enhance our practices and provide an even better service.

Infrastructure reliability

TODA Pay's payment platform operates on AWS, ensuring PCI compliance by following stringent security best practices and maintaining a high level of auditability.

- Hosting facilities

- 99.95% uptime

- Monitoring

- DDoS protection

- Latency

- Processing speed

- Scalability

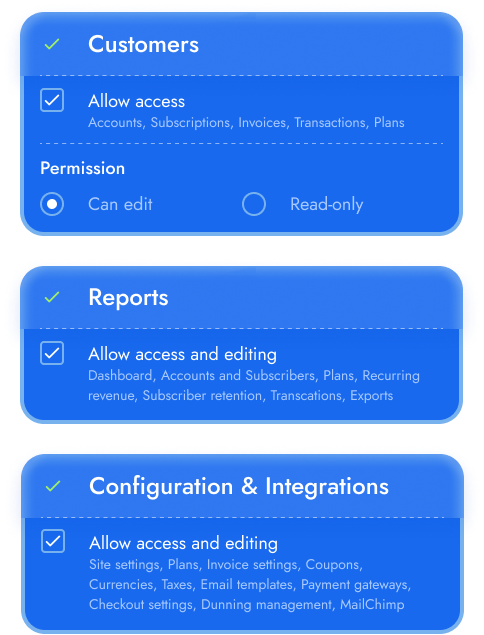

Security management

To safeguard against suspicious or unauthorized activities, we carefully monitor and analyze employee, customer, and vendor actions.

- Firewall

- Monitoring

- Penetration testing

- Scanning

- Vulnerability management

- Intrusion prevention system

Ultimate data protection

When evaluating information management solutions, data protection and security become paramount, particularly concerning your company's sensitive payment data.

- TLS 1.2 (SSL)

- Data encryption

- Card tokenisation

- No prohibited data storage

private stays private

In a trust-driven industry, Todapay instills confidence in businesses by employing sophisticated security practices to safeguard their data. Our dedicated team collaborates closely with each client, providing best practices to ensure the utmost privacy and protection of sensitive information.

SecurE access

Our capabilities will definitely help you to protect your business. But they work only if you apply them. Otherwise, your systems may be vulnerable.

SMART AND KEY-READY SECURITY toolkits

Our key-ready security solutions will give you an extra protection layer and help you idetify specific fraud transactions, managing all the risks in a more effective way.

- Blocking rule engine

- Smart blacklisting

- Smart 3DS routing

- Third-party risk scoring

Full 3D Secure support

We use 3D Secure authentication protocol, providing an extra layer of verification for card-not-present transactions. This protocol is compliant with authentication regulations, including the Strong Customer Authentication (SCA) mandate from PSD2.

- Support for both 3D Secure 1 & 2

- Keep your transactions SCA-compliant

- Shift chargeback liability

- Lift authorisation rates

- Take advantage of exemptions

Card vault & Tokenisation

TODA provides safe transactions and tokenised data with no extra fees. Receive the payments with or without PCI compliance by using our tokenisation technology. This will help you keep your customers’ data secured and focus more on your business.

- One card can be changed multiple times. Meanwhile, customer won’t need to re-enter the details.

- Enable a free of charge authorisation to block funds on the customer’s card to have time for customer verification, using our fraud score.

- You can use one-click payments to simplify the purchase-flow.

- Add just a few lines to your code to create charges or subscriptions.

How It Functions:

At the core of our platform lies a commitment to the security of payment data. We adhere to the strictest standards, conducting thorough security checks, employing secure data storage practices, implementing staff controls, and ensuring compliance with all relevant regulations. We take the matter of security extremely seriously to guarantee the utmost safety and reliability of our platform. We remain vigilant about emerging technologies, continually assessing risks and conducting independent audits to maintain stability, reliability, and safety throughout our platform.

We remain vigilant about emerging technologies, continually assessing risks and conducting independent audits to maintain stability, reliability, and safety throughout our platform.

PCI DSS:

Our platform adheres to the most rigorous security standard - PCI DSS Level 1. An annual on-site audit ensures the highest levels of compliance are upheld. This also enables us to shoulder the burden of PCI compliance on behalf of our clients, simplifying their interactions with banks. This level of compliance guarantees the complete protection of our clients and the sensitive data of their customers.

VISA TPA & MRP:

As registered participants in the Mastercard Registration Program and VISA Third Party Agent, we provide an additional layer of security for our clients.

ISO 9001, 27001:

The International Organization for Standardization (ISO) plays a vital role in ensuring secure online payments. We proudly hold certifications for both ISO 9001 and ISO 27001 standards. ISO 9001 sets out the requirements for a Quality Management System, helping organizations demonstrate their ability to deliver high-quality services and products. Todapay is also certified to ISO/IEC 27001:2013, covering Application, Systems, People, Technology, and Processes. Information security resulting from these standards leads to performance improvements, risk reduction, and enhanced customer convenience.

PSD2:

We are fully supportive of PSD2, the Payment Services Directive that replaces the 2007 version. This solution empowers third-party providers to manage bank customers' finances with direct permission and enhanced authentication. Under PSD2, customers grant consent for individual transactions as well as for third-party providers to access their bank-stored information.

GDPR:

GDPR is designed to safeguard the personal data and privacy of European Union citizens. This pan-European regulation ensures that the collection of clients' identity details occurs only with explicit and reasonable consent.

Credit Card Payments

Todapay empowers you to accept online payments through tokenization technology, which not only safeguards customer data but also enables business owners to concentrate on growth and development. Our robust API allows merchants to charge a single credit card multiple times without the necessity of re-entering payment details. Furthermore, we facilitate free-of-charge authorizations thanks to our fraud score system. Additionally, we offer one-click payments to streamline the purchasing process, enhancing customer satisfaction.

The Todapay anti-fraud system can be configured to operate based on various parameters, including:

1. Transaction limits originating from a single IP address.

2. Restrictions on transaction amounts.

3. Limits on the number of purchases.

4. Utilization of a dynamically changing algorithm.

5. Evaluation of customer behavior within the payment process.

6. Transaction analysis based on statistical data, among others.

Our anti-fraud system scrutinizes all transactions, flagging any abnormal or suspicious ones. It is also capable of pinpointing potential fraudsters with a high degree of accuracy or categorizing buyers' card transactions as trustworthy.

Experience secure payment processing without compromising your funds, reputation, or the sensitive data of your customers.