100% digitalisation

Enjoy flexibility and smooth cash flows.

Integrate TODA software equips for a complete set of smart routing and cascading tools. Ensure the maximum performance of all your operations.

Benefits of Routing & Cascading

Check some of the results after smart routing and cascading integration.

Smart payment routing

You can easily implement smart payment routing tool and alter your flow strategies. TODA Pay’s smart routing engine is able to maximise your payment performance. All the incoming and outgoing transactions may be optimised in a real-time mode which will help you to get the highest success rates.

Integrate and automate smart routing rules and strategies. Thus, all your transactions will be processed in the most optimal way.

- Multicurrency

- Auto-learning balancing

- Any payment method

- Custom business rules

- Unlimited number of schemes

- Graphical scheme editor

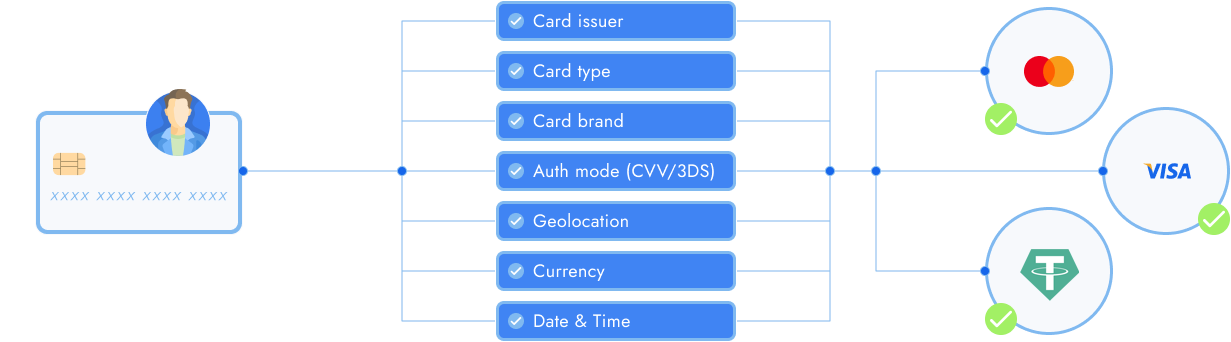

You can instantly analyze and route all the transactions through TODA. Our algorithms will manage everything to the optimal provider which is based on various flexible payment routing parameters.

TODA’s well-crafted optimisation presets may be used to distribute your cash flows as you desire. You can modify and combine them to achieve the greatest results in your business.

- Fees

- Conversions

- Balances

- Turnover

- Ratios

- Combined strategies

Extra features for SPECIAL business needs

Facilitate your business model and solve routine tasks easily with our intelligent processing features.

Cascading & Auto-retries

Sit back and watch your approval rates grow after setting up cascading and automatic retries.

-

Payment

Payment

-

TODApay

TODApay

-

Provider

Provider

If a transaction has failed, it can be automatically retried with another provider. This will help you to save your sales and increase conversion.

Get your business independent from any technical issues on PSP’s side. Accounts in the routing scheme can have their priority set up. Utilise cascading for successful transactions fulfilment.

You can monitor all available providers and connected accounts. This will help you to automatically reroute transactions until their successful completion.

PSPs' tokens can be smoothly sorted to ensure successful charging of a recurring payment.

KEY-READy fraud prevention TOOLS

We provide you with an efficient way to deal with any fraud transactions and manage the risks in your business in a smart way. This brings you additional security layer and help you to track some specific fraud issues.

- Blocking rule engine

- Smart blacklisting

- Smart 3DS routing

- Third-party risk scoring

The first is known as static payment routing. It requires manually creating complex routing schemes. Such schemes will then be used steadily to pass each transaction to the appropriate payment service provider, regardless of any changes.

The second is called dynamic payment routing. It is much more flexible because the rules used to distribute payments are dynamic. This means that they can switch in real time to adapt to changes.

Moreover, some payment service providers ensure intelligent payment routing, or smart routing. In fact, it's a solution that uses company transaction data to learn how to predict the best route for each individual transaction in real time.

- Your processing infrastructure includes more than one PSP or acquirer

- You provide services to customers from different countries and need to support both local and international payment methods

- The number of transactions processed by your company runs into the tens of thousands

- You are running a high-risk business

- Your company suffers from low conversion rates and technical failures on the part of the PSP.

These two online payment processing technologies are usually linked together.

Intelligent payment routing provides merchants working with multiple payment providers with an excellent opportunity to improve payment throughput, conversion rates and overall performance.

- Significantly lower transaction costs.

With multiple PSPs, you can send each payment to the provider that charges the lowest fee. This is especially important for merchants operating in different countries and using different currencies, since local acquirers charge high fees for processing transactions using foreign cards. What's more, the bank that issued the card will process the transaction faster and cheaper than another bank. Smart routing will allow you to benefit from these facts and save money.

- Protection against downtime and failed transactions.

Although smart routing is not a panacea for all payment problems, it helps reduce the risk of losses caused by unforeseen malfunctions on the part of a particular payment service provider. In addition, routing allows you to repeat a rejected transaction through another PSP and save your sales.