Unified online payments

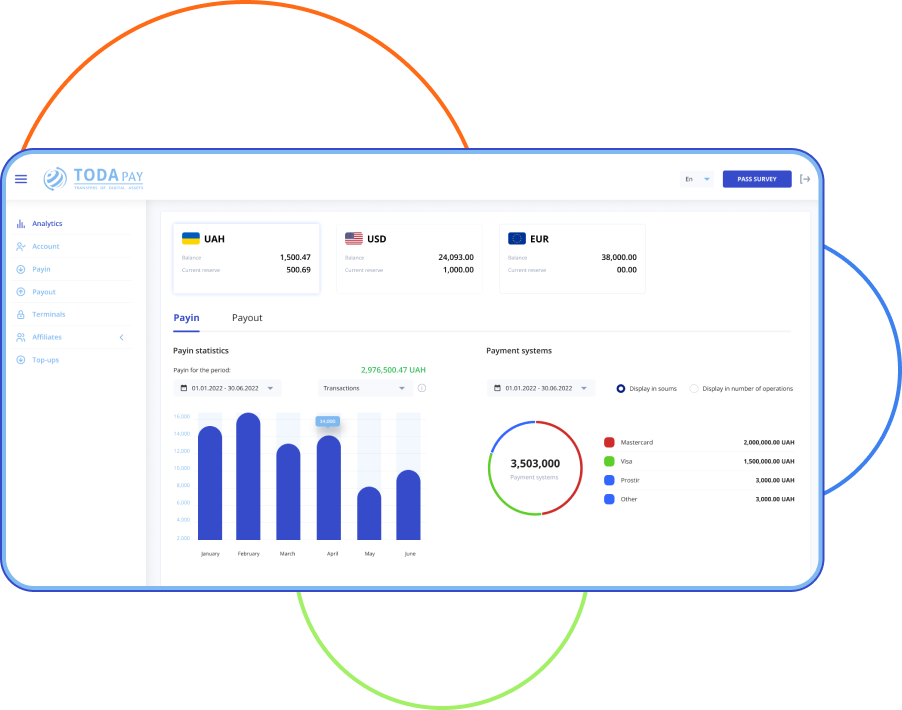

TODA Pay allows any business to standartise, centralise, and track its online payments. We connect our customers with hundreds of payment providers and acquirers in a few clicks. This will help you to control your transactions, having a clear view of the ongoing operations.

You will be able to support any payment methods with one single integration. It’s easy to incorporate our platform to your business.

Arrange an ongoing operations flow and track every single payment, working with multiple partners at the same time.

Manage all the payment sources in one place. Get a headache-free control to your data.

Manage your cash flows through payment providers and acquiring banks.

Connect payments

Multiversity of payments really matters to us. We strive to make any tool available to our customers and create ready-to-use payment integrations that are easy and convenient to any business worldwide.

We provide ready-to-use payment solutions, matching various online businessesAny payment provider

- Payment gateways

- Payment aggregators

- Payment facilitators

- Credit card acquirers

Any payment method

- Credit cards

- Bank transfers

- Digital wallets

- Cryptocurrencies

- Local payment options

Any payment flow

- Instant charge

- Delayed charge

- Recurring payments

- OCT (Original Credit Transaction)

Any fiat & crypto currency

- USD

- EUR

- GBP

- BTC

- USDT

- 50+ currencies

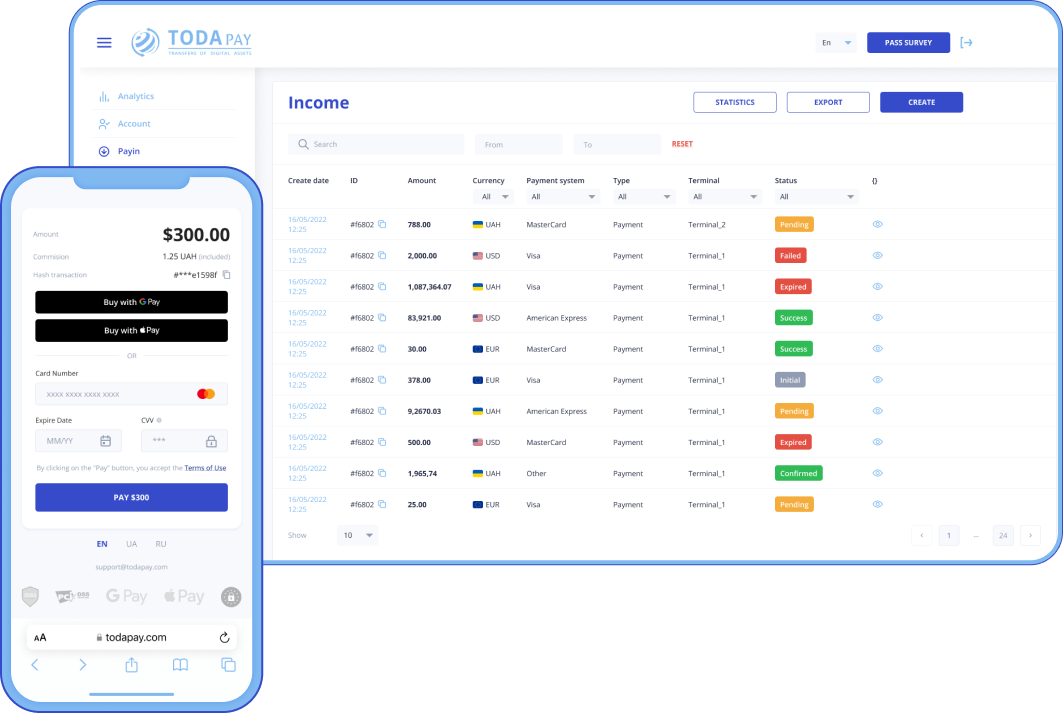

Accept payments

Accept online payments both automatically and manually with TODA. We bring you various payment options and ready-to-use solutions, matching your business.

-

Checkout

Collect online payments with the refined solution by adding just a few lines of code to your website.

- Increase your conversion rate

- Boost your company with customized UI

- Easy integration, minimal coding

- Personalised payment experience for any user

-

Recurring payments

All recurring online payments can be easily controlled and handled with the agile billing system.

-

Subscriptions

The workflow for subscription-based businesses can be fully automated and enhanced.

-

Invoicing

Issue and send invoices to your customers and get online payments.

-

Payment dashboard

Start accepting payments on your website after filling a short form on the Dashboard.

-

Payment links

Share a payment link via a preferred channel and get an instant payment.

Optimise payments

- Cascading

- Smart routing

- Anti-fraud

- Tokenisation

- Retries

- Best UX

- Personalisation

- Localisation

Raise your efficiency by setting optimal routing schemes. Every transaction may be automatically forwarded to the most efficient route, increasing the acceptance rate.

Every transaction becomes independent from PSP’s technical issues. Our platform incorporates a cascade function which minimises payment delays and brings any operation to a successful completion.

Multiple payment providers and methods will help you to handle bulk payments easily.

Our system includes a set of various security tools, helping you to instantly spot a fraudulent transaction and avoid time and money losses.

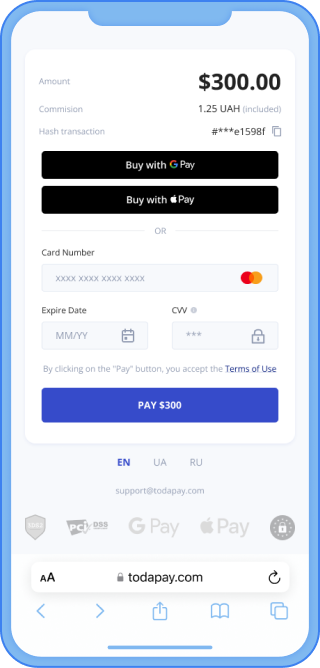

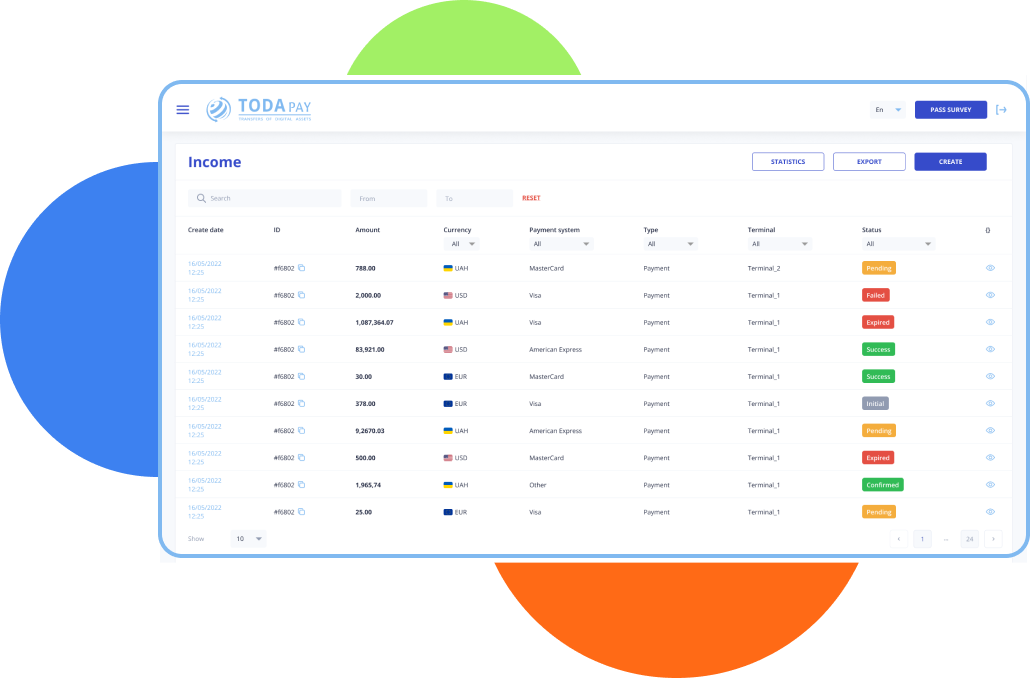

Dashboard

No need for an exra coding. Our feature-rich UI allows you to easily handle daily operations, feeling free from complex technical issues.

- Global search

- Transactions & Timeline

- Callbacks

- Team activity log

- Provider statements and logs

AnalysIS

With the real-time transactions data and instant reports, you can make smart and efficient decions, having a positive impact on all the aspects of your business.

IntegratION

Our credo is to make the complex things easy. Thus, you’ll have everything needed to start working with us: no hassle and time-consuming procedures. Smart handling of your payments issues is a few minutes from you.

- APIs. We offer both server and client APIs, along with detailed API references with thorough guides.

- Docs. Our documentation is clear and transparent. Check it and we can get started right away.

- Callbacks. Be automatically notified of everything that happens to your transactions.

Payment gateways EXPLAINED

We understand that every business is unique. Meanwhile, most of them have something in common.

Thus, we brought together all the payment gateway information about companies of different types, sizes, and industries. Check the one matching your business and feel free to ask us any questions.

- daily turnover

- customers geography

- acquirer availability and others.

- transmitted data encryption

- customers' personal data masking

- card data tokenization

- anti-fraud system

-multi-level authorization system for a personal account

- PCI DSS and GDPR compliance.

Second, evaluate the possibilities of a payment solution to provide all the payment acceptance methods for your business. You should be able to work not only with VISA and MASTERCARD, but also with:

- local payment systems

- electronic wallets

- special local online payment methods in the payers' geography.

Third, estimate the cost of the proposed solution, taking into account all the benefits of it. Normally, the use of a payment aggregator increases the amount of commission for processing payments. However, it significantly increases the conversion and channel stability. Plus, it saves a lot of money on the developers team maintenance, supporting and constantly developing such a system.